Purchasing health insurance is a significant decision. And it’s one that can be quite confusing and difficult. Nevertheless, buying insurance is a vital step towards a stability, as paying full price for medical procedures and doctors’ visits can break the bank.

Unfortunately, insurance companies offer numerous policies and use complicated jargon that makes choosing the correct health insurance very difficult.

Before you choose a certain health plan, make sure you are familiar with everything health insurance can offer you.

How Does Health Insurance Work?

Insurance is a commonplace term in today’s world, but not everyone understands how it works. The basic idea of insurance is that policy holders pay a certain amount to maintain coverage. Zeroing in on health insurance specifically, the goal is to help people pay the incredibly high medical bills that result from an illness, accident, or even routine care.

Life is unexpected, and health insurance helps you plan for the unknown. Also, if you have a family, or are thinking of starting one, health insurance is a necessity to provide the best care for your children. You don’t want to get stuck with a hundred thousand dollar bill for an unforeseen procedure that could wipe out your bank account.

So, how does it work?

Each health insurance plan is slightly different, but essentially you need to pay a monthly or yearly fee (with potential added expenses) to make sure that you are protected. Some insurance plans only cover hospital stays and emergencies, while many plans provided by an employer include routine care and dental for the whole family.

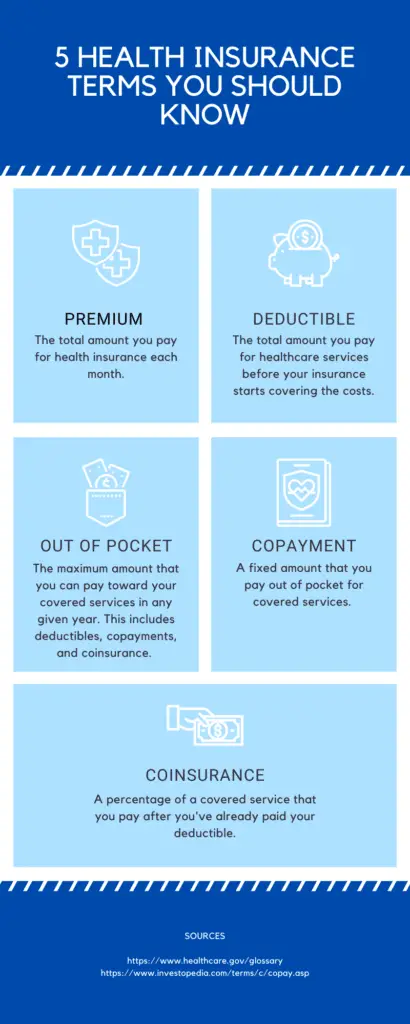

While having insurance at the time of an accident is a lifesaver, unfortunately, it is not usually free. There are four main payment options that a health insurance policy can include.

- Monthly premiums

- A deductible

- A co-payment

- The co-insurance

What Are Monthly Premiums?

Health insurance premiums can be charged annually or monthly, but most people opt for the monthly option since paying a lump sum at the beginning of the year can take a significant chunk out of your bank account.

The monthly premiums for health insurance are the general cost of having insurance. It is similar to other monthly payments for services you may have like internet or Netflix. The price is set and depends on various health factors, such as age, state of residence, and health history.

How Does Health Insurance Deductible Work?

If you opt for a low deductible, that usually results in a higher monthly premium.

Either way, you need to pay for the insurance.

A deductible states how much you will pay versus how much the health insurance company will cover. For example, if you choose a health insurance deductible of $1,000, you will pay the first $1,000 of your medical fees, then the insurance company covers the rest.

The deductible usually refers to a full year, so when choosing a deductible consider how much you would be able to spend for medical bills on top of your premium.

If you opt for a low deductible, that usually results in a higher monthly premium. Either way, you need to pay for the insurance, whether it is at the time of need or in monthly installments.

Since some procedures and medical services are incredibly costly, many people opt for a lower deductible, or even $0. That way, they know exactly how much per month they will be spending on insurance and won’t be surprised by a large medical bill.

Take some time to consider your budget and how often you require medical care to decide whether a higher premium or higher deductibles is the right choice for you.

What Is a Copay in Insurance?

A copy, or copayment, is a set amount that you must pay for certain medical services, such as a routine doctor visit, prescription drugs, or an appointment with a specialist. The copays for each of these options can vary and depend on your policy.

The copays are set, so no matter the cost of the visit or the medication, you will pay the same amount while the insurance company covers the rest. For example, if your policy states that you must pay a $20 copay for regular visits, $30 for specialists, and $15 for medication, those prices will not change even if the outright cost of the health care services is much higher.

It is quite possible that your insurance plan includes copays in addition to deductibles and premiums. Some plans even count the copay cost towards your deductible, which helps you reach that amount quickly. Since copays are set rates for covered services, you will pay that price whether or not you’ve met your deductible. The cost of other health services not under a copay will usually count towards your deductible, like specialized treatment or hospital care.

How Does Coinsurance Work?

Many health insurance plans include a coinsurance percentage, or a cost-sharing plan, which comes into play after you have met your deductible. For example, if your deductible is $1,000 and you have a coinsurance of 30%, once you have paid the first $1,000, you must also pay 30% of the medical bills for that year.

Of course, a higher coinsurance percentage requires you to pay a larger portion of the medical bills. However, coinsurance can help turn a $120,000 medical bill into $36,000.

If you’re thinking that $36,000 is still a lot to pay, make sure your insurance plan includes an out-of-pocket maximum. This amount represents the most money that you will spend annually on medical expenses. If you have an out-of-pocket maximum of $10,000, that means all your copays, deductibles, and coinsurance will all count towards that dollar amount.

So, let’s go back to that $120,000 procedure. If you have not already met your deductible of $1,000, you will pay that first. Then, you’ll pay 30% of the remaining $119,000. However, your out-of-pocket cost maximum is $10,000, and you’ve already spent $1,000 in deductibles, so the most you could pay for the procedure is $9,000 while the insurance company covers the rest.

While all of these payment methods may seem expensive at first, they all work together to make sure that you pay only a fraction of large, intimidating medical bills.

How Does Employer Health Insurance Work?

About half of all Americans receive health insurance through their employer.

Kaiser Family Foundation

According to the Kaiser Family Foundation, about half of all Americans receive health insurance through their employer . While you won’t get to choose between numerous different plans like you would when you purchase health insurance on your own, the employing company does help cover some of the costs.

Each company handles mandated health insurance differently. Some require their employees to share a portion of the premium cost by taking it out of their salary, while others don’t charge a dime. Additionally, some smaller companies require the employer to pay their own deductible instead of the business covering it.

Employees often opt for preferred provider organizations or PPOs. This system gives them a list of doctors to choose from when seeking medical care. If you choose a doctor from the ones provided, the copays are usually quite low. You can visit a doctor outside of the network, but the payment will be higher.

Another option for employer health insurance is a health maintenance organization or HMO. Again, this group provides a specific list of doctors to choose from for your medical care. The main difference between an HMO and a PPO is that the HMO requires you to stay within the offered doctors.

Why Is Health Insurance Important?

Health insurance may seem like a burden and unnecessary cost if you have been relatively healthy. However, unforeseen accidents, diseases, and sicknesses can cause bankruptcy if you aren’t prepared for them.

Health insurance helps prepare you for the unknown and gives peace of mind to you and your family.

What Is the Penalty for Not Having Health Insurance?

Prior to 2019, the federal government had a penalty for being uninsured. The fine in place was $695 for adults and $347.50 for children or 2% of your annual salary. This penalty was enacted to encourage every individual and family to seek health insurance coverage so they could pay for any medical needs.

However, this penalty no longer applies. However, it’s important to check your state laws. Even though this penalty was rescinded in 2019, some states still have rules making sure you have insurance and that it is ACA-compliant (adheres to the Affordable Care Act).

Do You Need Health Insurance?

The simple answer is yes. We don’t know what tomorrow holds, and it is always vital to be prepared. If you are hesitant about all the different costs involved with health insurance, remember that the monthly fees will keep you from paying hundreds of thousands of dollars later on. It’s also important to remember that there are resources available to help individuals of all income levels manage and understand their insurance costs.

Keep in mind that the cost of premiums is significantly less than what you would have to pay out of pocket for treatments, surgery, or hospital stays. Whether you are young and single or looking to retire, health insurance is a must to ensure you enjoy health and stability in the future.