When is the right time to enroll in a high deductible health insurance plan? To answer that, you’ll need to know more about how they work and what they can do for you. An HDHP can help you to save money, but only in the right situations. For others, this type of plan can be too much of a financial burden.

In other words, a high-deductible health plan is not for everyone. However, it may be right for you. This article will discuss the pros and cons of this type of health insurance and give you all of the information you need to make the right decision.

Overview of High Deductible Health Insurance Plans

A high-deductible health plan is a form of health insurance in which policy holders pay lower monthly premiums in exchange for higher deductibles or copays. In comparison with a PPO, or Preferred Provider Organization plan, an HDHP has lower monthly premiums.

While a PPO is sometimes called a “traditional” plan because it is often offered by employers, switching to an HDHP can save you money as long as you don’t go to the doctor too frequently or have a significant accident.

With an HDHP, the higher deductible you’ll pay is offset by lower monthly premiums. So, you can sometimes save several hundred dollars each year by opting for this type of coverage. Of course, it’s crucial that you have the funds to meet your higher deductible in the event you have a significant accident or illness.

Limits of a High Deductible Health Insurance Plan

A high-deductible health insurance plan is defined as one with a deductible of at least $1,400 (as of the year 2020) for individuals and at least $2,800 for a family plan.

A high-deductible health insurance plan is defined as one with a deductible of at least $1,400 (as of the year 2020) for individuals and at least $2,800 for a family plan. This annual deductible is the amount you’ll pay out of pocket before your insurance pays for anything.

On top of that, the IRS sets limits on the maximum amount you’ll have to pay for in a year with an HDHP. For an individual, that amount is $6,900, and for you and your family members, it is $13,800 annually. However, it’s crucial to note that these numbers are only the legal limits and that each particular plan may be set up differently.

Pros

When it comes to medical expenses, health insurance is vital. A high-deductible health plan will generally have lower premiums than the equivalent coverage through other health insurance plans. This is offset by a high deductible and higher out-of-pocket cost for care.

If you don’t plan on having very many health care expenses over the year, a high-deductible health plan makes sense for minimal premiums and a much lower annual rate. An HDHP is perfect for anyone who rarely needs doctor visits and is in generally good health.

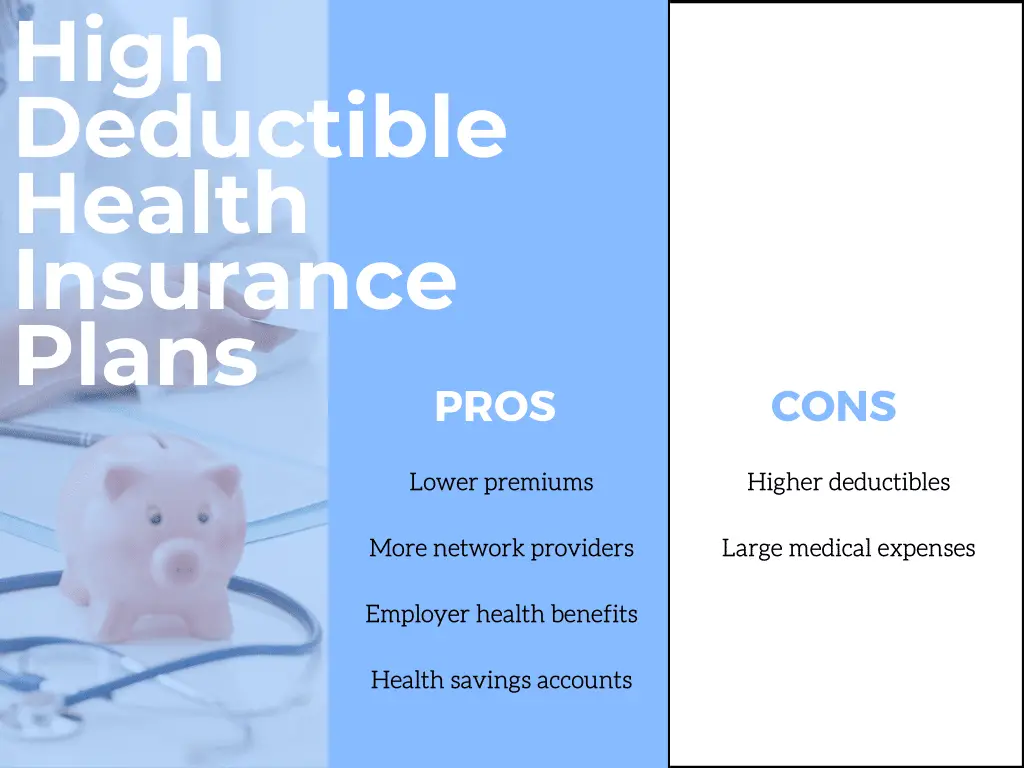

The pros of high deductible health insurance plans include:

- Lower Premiums: As health care costs continue to go up, being able to cut down higher premiums is always suitable for your day-to-day finances.

- More Network Providers: HDHPs tend to offer more providers than other health insurance plans. While this is not always the case, you might be glad to have health coverage if there’s ever an emergency while you’re traveling.

- Employer Health Benefits: Companies that offer an HDHP as a benefit will match your contributions to the plan.

- Health Savings Accounts: With an HDHP, you’re generally eligible for a health savings account or HSA. This account is a tax shelter for medical expenses.

Health Savings Accounts

A quick note on health savings accounts… If you have a high-deductible health plan and are eligible for a health savings account, it’s usually a good idea to get one. An HSA allows you to make tax-free contributions to the account that will accumulate tax-free interest. Then, you can use the funds in your HSA for medical expenses with tax-free withdrawals.

Cons

While healthcare is essential for everyone, some need it more than others. If the thought of paying a high deductible is going to prevent you from seeking the care you need, an HDHP is probably not for you. Choosing a lower deductible plan may make more sense.

With a high deductible health insurance plan, you’re going to be paying more depending on out of pocket maximums before your plan kicks in and starts covering your medical expenses. For this reason, it’s crucial to weigh the amount you’ll save each month by paying lower premiums against how much you might pay for medical care during the year.

The cons of high-deductible health plans include:

- Higher Deductibles: It’s no surprise that an HDHP has high deductibles. This means that you will have a lot more you’ll have to pay for yourself to get care before your insurance begins to cover things. The one exception to this is preventative care, which is usually covered 100% in-network.

- More Out-of-Pocket Expenses: With an HDHP, medical costs can be high. For anything that is not preventative, you’ll be stuck with high out-of-pocket co-payments before your insurance company begins to help. Depending on the nature of your medical needs, including use of prescription drugs, these expenses could be more considerable than you’re prepared to handle.

Main Takeaways

The bottom line is if you’re healthy and rarely go to the doctor, paying smaller monthly premiums may be the way to go. Whether a high deductible health insurance plan is right for you largely depends on your stage of life. If you’re young and don’t have a chronic condition, consider skipping a low deductible health insurance plan, as it could save you a lot of money.

On the other hand, if you have a chronic condition that needs consistent care or take medications, a more traditional health insurance plan may be better. Also, if you’re planning to have a baby anytime soon, medical expenses can add up quickly as babies, and small children typically go to the doctors a lot.

Either way, it’s best to weigh the pros and cons when choosing the best health insurance plan for you and your family. If you’re not concerned about ongoing medical expenses and have a backup plan in case of a catastrophic emergency, a high deductible health plan may be what you’re looking for.